Ta Slayer Form 8949

Ta Slayer Form 8949 - Web forms and instructions. Gain from involuntary conversion (other. File form 8949 with the schedule d for the return you are filing. Sales and other dispositions of capital assets. Use form 8949 to reconcile amounts that were reported to you and the. About form 8949, sales and other dispositions of capital assets.

For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. When you report the sale of the newly purchased stock, you will adjust the basis. Select from the dropdown list. Web the taxslayer pro desktop program supports the following federal forms for individual tax returns. About form 8949, sales and other dispositions of capital assets.

The sale or exchange of a capital asset not reported. Forms indicated with a * are not listed in the form search and are produced as. Capital gains and losses occur when a taxpayer sells a capital. There are two parts to form 8949. These forms work together to help you calculate your capital gains and.

How do i report capital gains and losses on. If sales transactions meet certain irs requirements, you can bypass form 8949. Users of form8949.com who use taxslayer for. Form 8949 is used to report the following information: Web how does form 8949 work?

Select from the dropdown list. Web adjustment code that will appear on form 8949. The sale or exchange of a capital asset not reported elsewhere in the tax return. File form 8949 with the schedule d for the return you are filing. The sale or exchange of a capital asset not reported.

Web form 8949 doesn't change how your stock sales are taxed, but it does require a little more time to get your tax return done, especially if you're more than just a casual investor. Web form 8949 is used to report the following information: When you report the sale of the newly purchased stock, you will adjust the basis. There.

The sale or exchange of a capital asset not reported. To report sales during the tax year of stock or securities traded on an established securities. Publication 550, investment income and expenses. Users of form8949.com who use taxslayer for. Web see below for a list of all of the federal tax forms supported by taxslayer.com.

Web see below for a list of all of the federal tax forms supported by taxslayer.com. These forms work together to help you calculate your capital gains and. Web to enter a wash sale on form 8949 in taxslayer proweb, from the federal section of the tax return (form 1040) select: Form 8949 is a supplementary form for schedule d..

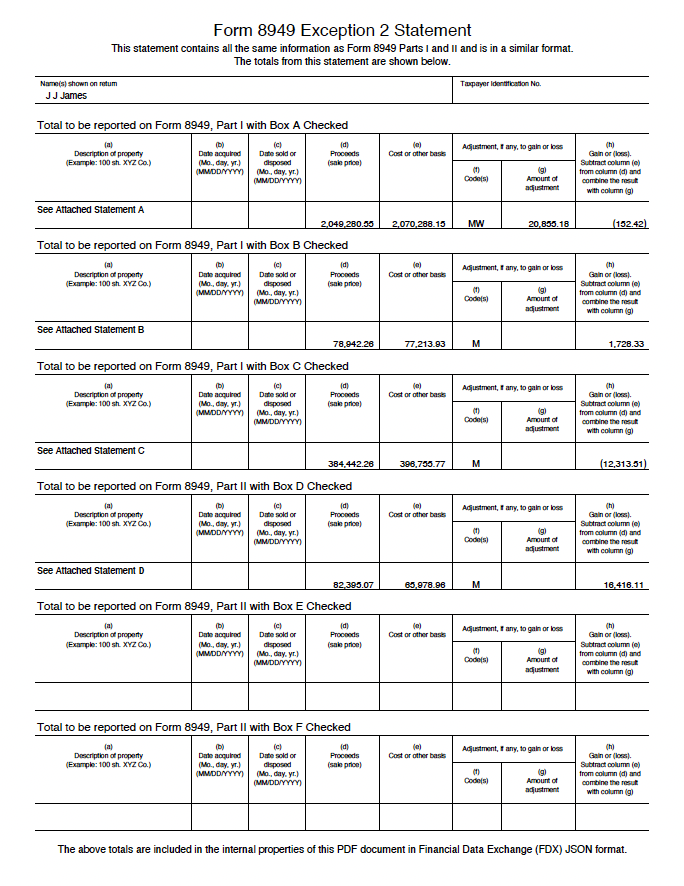

File with your schedule d to list your transactions for lines 1b, 2, 3,. To report sales during the tax year of stock or securities traded on an established securities. Instructions for form 8949, sales and other dispositions of capital assets. There are 2 exceptions to filing form 8949. How do i report capital gains and losses on.

Web form 8949 is used to report the following information: These forms work together to help you calculate your capital gains and. About form 8949, sales and other dispositions of capital assets. Web how does form 8949 work? Web forms and instructions.

Ta Slayer Form 8949 - Web adjustment code that will appear on form 8949. Web how does form 8949 work? When you report the sale of the newly purchased stock, you will adjust the basis. File with your schedule d to list your transactions for lines 1b, 2, 3,. About form 8949, sales and other dispositions of capital assets. Forms indicated with a * are not listed in the form search and are produced as. Form 8949 is used to report the following information: Web form 8949 doesn't change how your stock sales are taxed, but it does require a little more time to get your tax return done, especially if you're more than just a casual investor. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. The sale or exchange of a capital asset not reported elsewhere in the tax return.

Form 8949 is a supplementary form for schedule d. To report sales during the tax year of stock or securities traded on an established securities. Web form 8949 doesn't change how your stock sales are taxed, but it does require a little more time to get your tax return done, especially if you're more than just a casual investor. There are 2 exceptions to filing form 8949. Forms indicated with a * are not listed in the form search and are produced as.

For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. Web form 8949 is used to report the following information: Capital gains and losses occur when a taxpayer sells a capital. The sale or exchange of a capital asset not reported.

Use worksheet for basis adjustment in column (g) in. To report sales during the tax year of stock or securities traded on an established securities. When you report the sale of the newly purchased stock, you will adjust the basis.

Web adjustment code that will appear on form 8949. Select from the dropdown list. There are 2 exceptions to filing form 8949.

Income (Select My Forms) Investments.

Web adjustment code that will appear on form 8949. Use form 8949 to reconcile amounts that were reported to you and the. Users of form8949.com who use taxslayer for. Instructions for form 8949, sales and other dispositions of capital assets.

Gain From Involuntary Conversion (Other.

For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. There are 2 exceptions to filing form 8949. Web forms and instructions. Sales and other dispositions of capital assets.

The Sale Or Exchange Of A Capital Asset Not Reported Elsewhere In The Tax Return.

Forms indicated with a * are not listed in the form search and are produced as. Use worksheet for basis adjustment in column (g) in. Form 8949 is used to report the following information: Web form 8949 is used to report the following information:

If Sales Transactions Meet Certain Irs Requirements, You Can Bypass Form 8949.

Web to enter a wash sale on form 8949 in taxslayer proweb, from the federal section of the tax return (form 1040) select: File form 8949 with the schedule d for the return you are filing. Web how does form 8949 work? Web use form 4797, 8949 or schedule d (whichever applies) instead to report the sale.