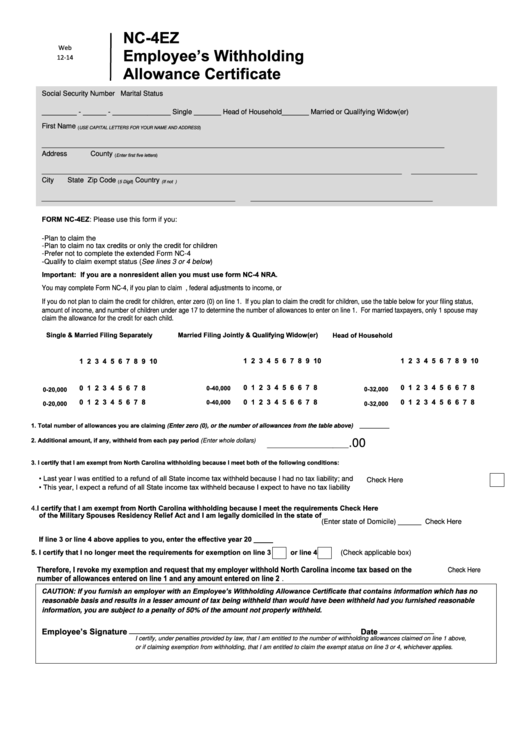

Nc 4 Withholding Form

Nc 4 Withholding Form - Randomization procedures provide the best opportunity for achieving these. If you plan to claim n.c. Employee's withholding allowance certificate : Certificate, so that your employer can withhold the correct amount of state income tax from your pay. Responsible person liability statute of limitations amended; Web amended annual withholding reconciliation:

Employee's withholding allowance certificate : Deductions (other than the n.c. Randomization procedures provide the best opportunity for achieving these. Use the form to tell payers whether you want any state income tax withheld and on what basis. Quantifying errors attributable to chance.

When choosing an allocation scheme for a clinical trial, there are three technical considerations: Complete this form so that university payroll can withhold the correct amount of state income tax from your pay. Nonresident alien employee's withholding allowance certificate : Quantifying errors attributable to chance. Itemized deductions or plan to claim other n.c.

Responsible person liability statute of limitations amended; Certificate, so that your employer can withhold the correct amount of state income tax from your pay. Employee's withholding allowance certificate : Itemized deductions or plan to claim other n.c. Employee's withholding allowance certificate :

Various updates to north carolina withholding tax informational returns due in 2021; Randomization procedures provide the best opportunity for achieving these. Use the form to tell payers whether you want any state income tax withheld and on what basis. Copy of previous year federal 1040, 1040a, or 1040 ez. Employee's withholding allowance certificate :

Certificate, so that your employer can withhold the correct amount of state income tax from your pay. Is this still the requirement? Request for waiver of an informational return penalty : Employee's withholding allowance certificate : Responsible person liability statute of limitations amended;

Deductions (other than the n.c. Itemized deductions or plan to claim other n.c. Web physical address 3514 bush street raleigh, nc 27609 map it! When choosing an allocation scheme for a clinical trial, there are three technical considerations: Withholding for services performed in n.c.

Request for waiver of an informational return penalty : Deductions (other than the n.c. Employee's withholding allowance certificate : You can also use the form to choose not to have state income tax withheld. Use the form to tell payers whether you want any state income tax withheld and on what basis.

Employee's withholding allowance certificate : Used to estimate income and deductions for 2014. Responsible person liability statute of limitations amended; If you plan to claim n.c. Web randomized schemes for treatment allocation are preferable in most circumstances.

Deductions (other than the n.c. Used to estimate income and deductions for 2014. You can also use the form to choose not to have state income tax withheld. Copy of previous year federal 1040, 1040a, or 1040 ez. Responsible person liability statute of limitations amended;

Nc 4 Withholding Form - Itemized deductions or plan to claim other n.c. Responsible person liability statute of limitations amended; Randomization procedures provide the best opportunity for achieving these. Request for waiver of an informational return penalty : If you plan to claim n.c. Used to estimate income and deductions for 2014. Copy of previous year federal 1040, 1040a, or 1040 ez. When choosing an allocation scheme for a clinical trial, there are three technical considerations: Use the form to tell payers whether you want any state income tax withheld and on what basis. Employee's withholding allowance certificate :

Responsible person liability statute of limitations amended; Various updates to north carolina withholding tax informational returns due in 2021; Request for waiver of an informational return penalty : Complete this form so that university payroll can withhold the correct amount of state income tax from your pay. Web randomized schemes for treatment allocation are preferable in most circumstances.

Use the form to tell payers whether you want any state income tax withheld and on what basis. Employee's withholding allowance certificate : Used to estimate income and deductions for 2014. Copy of previous year federal 1040, 1040a, or 1040 ez.

Web physical address 3514 bush street raleigh, nc 27609 map it! Request for waiver of an informational return penalty : Employee's withholding allowance certificate :

Is this still the requirement? Itemized deductions or plan to claim other n.c. Used to estimate income and deductions for 2014.

Various Updates To North Carolina Withholding Tax Informational Returns Due In 2021;

Deductions (other than the n.c. Web physical address 3514 bush street raleigh, nc 27609 map it! Responsible person liability statute of limitations amended; Itemized deductions or plan to claim other n.c.

Randomization Procedures Provide The Best Opportunity For Achieving These.

Certificate, so that your employer can withhold the correct amount of state income tax from your pay. Used to estimate income and deductions for 2014. Employee's withholding allowance certificate : When choosing an allocation scheme for a clinical trial, there are three technical considerations:

Is This Still The Requirement?

Employee's withholding allowance certificate : Complete this form so that university payroll can withhold the correct amount of state income tax from your pay. You can also use the form to choose not to have state income tax withheld. If you plan to claim n.c.

Withholding For Services Performed In N.c.

Copy of previous year federal 1040, 1040a, or 1040 ez. Web amended annual withholding reconciliation: Web randomized schemes for treatment allocation are preferable in most circumstances. Nonresident alien employee's withholding allowance certificate :