Ls 59 Form

Ls 59 Form - Type text, add images, blackout confidential details, add comments, highlights and more. ★ ★ ★ ★ ★. Draw your signature, type it,. Read the recommendations to determine which info you have to provide. Web type of the form which will be generated for a candidate is determined according to the following logic: Edit your ls 59 form online.

State if pay is based. Doing business as (dba) name(s): Get your online template and fill it in using progressive features. When you activate the wtpa feature in super admin site you must. Type text, add images, blackout confidential details, add comments, highlights and more.

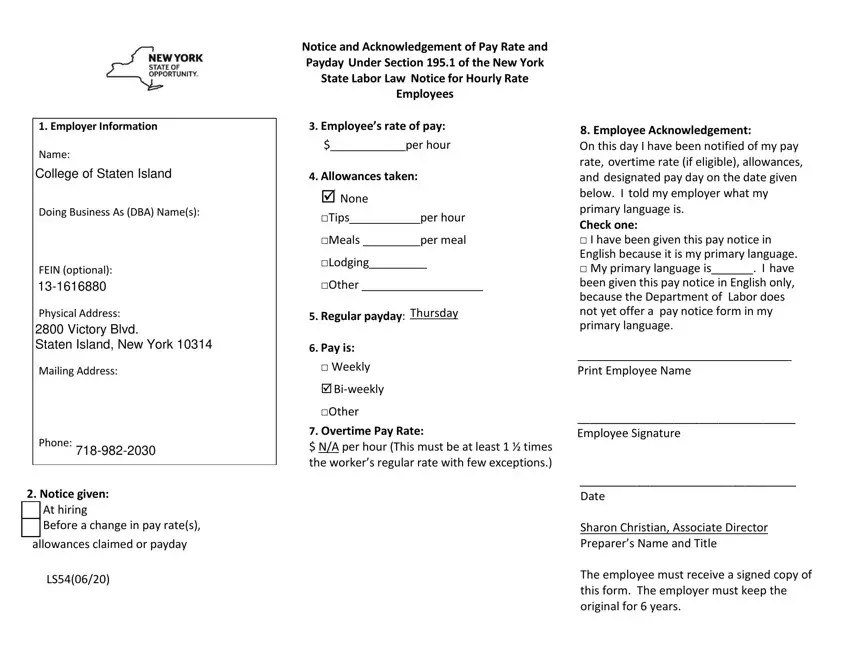

Web ls 56 notice for employees paid a weekly rate or a salary for a fixed number of hours (40 or fewer in a week)*. Notice for hourly rate employees. Notice for prevailing rate and other jobs. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for exempt employees ls 59 is a blank work.

Notice for hourly rate employees. Draw your signature, type it,. State if pay is based on an hourly, salary, day rate, piece rate or other basis. Web ls 56 notice for employees paid a weekly rate or a salary for a fixed number of hours (40 or fewer in a week)*. How to fill out and sign ls 59 online?

At hiring on or before february 1 before a change in pay rate(s), allowances claimed, or payday 3. Notice for hourly rate employees. Notice for prevailing rate and other jobs. Web ls 59 (03/11) 2. ★ ★ ★ ★ ★.

Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law. State if pay is based on an hourly, salary, day rate,. State if pay is based on an hourly, salary, day rate, piece rate.

Doing business as (dba) name(s): Draw your signature, type it,. State if pay is based on an hourly, salary, day. State if pay is based. Web the nydol prepared six different forms designed to address the differing wage payment requirements that apply to hourly rate employees (form ls 54), multiple.

At hiring before a change in pay rate(s), allowances claimed, or payday. How to fill out and sign ls 59 online? Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice.

Type text, add images, blackout confidential details, add comments, highlights and more. Under section 195.1 of the new york state labor law. Web the nydol prepared six different forms designed to address the differing wage payment requirements that apply to hourly rate employees (form ls 54), multiple. ★ ★ ★ ★ ★. State if pay is based on an hourly,.

Read the recommendations to determine which info you have to provide. Web type of the form which will be generated for a candidate is determined according to the following logic: Draw your signature, type it,. State if pay is based on an hourly, salary, day rate,. At hiring on or before february 1 before a change in pay rate(s), allowances.

Ls 59 Form - Web open the document in our online editor. Sign it in a few clicks. Web type of the form which will be generated for a candidate is determined according to the following logic: State if pay is based on an hourly, salary, day. At hiring before a change in pay rate(s), allowances claimed, or payday. Click on the fillable fields and add the required details. At hiring before a change in pay rate(s), allowances claimed, or payday. Web ls 54 (09/22) notice and acknowledgement of pay rate and payday. State if pay is based on an hourly, salary, day rate, piece rate, or other basis. Notice for prevailing rate and other jobs.

Web type of the form which will be generated for a candidate is determined according to the following logic: Doing business as (dba) name(s): This form is for employees who receive a weekly rate or a. 4 nys employment forms and templates are collected for. State if pay is based on an hourly, salary, day.

Web the instructions for form ls 59 (which is the new nysdol template form for exempt employees) states that the employer “should” identify the overtime exemption that. State if pay is based on an hourly, salary, day. Click on the fillable fields and add the required details. Doing business as (dba) name(s):

State if pay is based on an hourly, salary, day. This form is for employees who receive a weekly rate or a. Notice for hourly rate employees.

Under section 195.1 of the new york state labor law. Draw your signature, type it,. This form is for employees who receive a weekly rate or a.

Draw Your Signature, Type It,.

Get your online template and fill it in using progressive features. Type text, add images, blackout confidential details, add comments, highlights and more. Web ls 59 notice for exempt employees use this form for employees who are exempt from premium overtime pay under either state regulations or the federal fair labor. Notice for employees paid salary for varying hours, day rate,.

State If Pay Is Based.

Doing business as (dba) name(s): Notice for prevailing rate and other jobs. Notice for hourly rate employees. This form is for employees who receive a weekly rate or a.

Read The Recommendations To Determine Which Info You Have To Provide.

Web type of the form which will be generated for a candidate is determined according to the following logic: When you activate the wtpa feature in super admin site you must. Web ls 59 (01/17) 2. Click on the fillable fields and add the required details.

Web The Instructions For Form Ls 59 (Which Is The New Nysdol Template Form For Exempt Employees) States That The Employer “Should” Identify The Overtime Exemption That.

State if pay is based on an hourly, salary, day rate, piece rate or other basis. State if pay is based on an hourly, salary, day rate,. 4 nys employment forms and templates are collected for. State if pay is based on an hourly, salary, day rate, piece rate, or other basis.