Irs Form 4549 Instructions

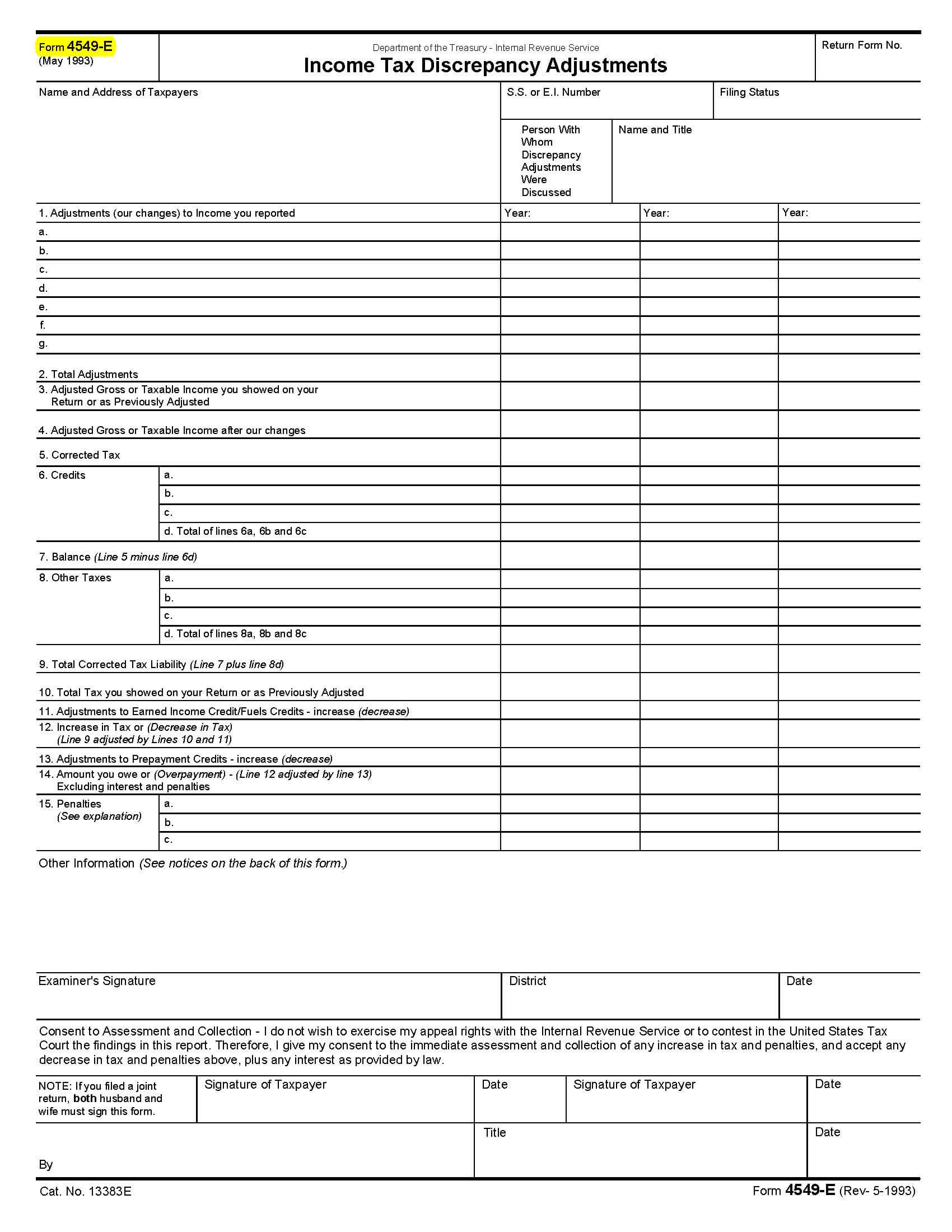

Irs Form 4549 Instructions - This is only a proposal & they may issue revisions if you present further evidence. Web the form 4549 instructions on your form will explain what you should do if you disagree. In any of the four situations below, you can request an audit reconsideration. Web a regular agreed report (form 4549) may contain up to three tax years. If you understand and agree with the proposed changes, sign and date the form 4549. Web form 4549, report of income tax examination changes, with an explanation of each item of adjustment, a computation of tax and penalties (if applicable), and a copy of the signed civil penalty approval form (if applicable).

Web a regular agreed report (form 4549) may contain up to three tax years. Web schedules for form 1040. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. You disagree with the tax the irs says you owe. In any of the four situations below, you can request an audit reconsideration.

Web a process that reopens your irs audit. Essentially, if the irs conducts an audit of your tax return and determines that changes are necessary, they will outline these adjustments in form 4549. But there are certain times when they are more likely to use this letter. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. This letter is also used as an initial reporting tool.

Disagree with an internal revenue service (irs) audit and the additional tax the irs says you owe in taxes? Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web form 4549, report of income tax examination changes, with an explanation of each item of.

Form 4549, income tax examination changes, can be a refund claim. If you understand and agree with the proposed changes, sign and date the form 4549. Web schedules for form 1040. Web you cannot agree with the audit, pay your balance, and then apply for reconsideration — the audit reconsideration process must take place before your tax liability has been.

But, often times, it seems they ignore your evidence or reject it with little or no explanation at all. It will include information, including: The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. You never appeared for the audit appointment or sent the irs.

You have new information to show the irs about the audit of your income or expenses. Web form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of.

This letter is also used as an initial reporting tool. They will issue you a form 4549 to propose a determination that you owe more taxes. What are my rights as a taxpayer? Web form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Web steps in response to.

They will issue you a form 4549 to propose a determination that you owe more taxes. You have new information to show the irs about the audit of your income or expenses. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. The irs uses.

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes proposed by the department for your tax return.

Irs Form 4549 Instructions - In any of the four situations below, you can request an audit reconsideration. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web steps in response to form 4549. Web you cannot agree with the audit, pay your balance, and then apply for reconsideration — the audit reconsideration process must take place before your tax liability has been satisfied. Web form 4549, report of income tax examination changes, with an explanation of each item of adjustment, a computation of tax and penalties (if applicable), and a copy of the signed civil penalty approval form (if applicable). Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web schedules for form 1040. What are my rights as a taxpayer? Web the irs form 4549 is the income tax examination changes letter. Include a statement explaining why you disagree with form 4549.

Web you cannot agree with the audit, pay your balance, and then apply for reconsideration — the audit reconsideration process must take place before your tax liability has been satisfied. Web a regular agreed report (form 4549) may contain up to three tax years. May 30, 2019 · 5 minute read. You have new information to show the irs about the audit of your income or expenses. You disagree with the tax the irs says you owe.

May 30, 2019 · 5 minute read. Disagree with an internal revenue service (irs) audit and the additional tax the irs says you owe in taxes? Web the form 4549 instructions on your form will explain what you should do if you disagree. But, often times, it seems they ignore your evidence or reject it with little or no explanation at all.

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. (january 2019) report of income tax examination changes. In any of the four situations below, you can request an audit reconsideration.

Form 4549, income tax examination changes, is used for cases that result in: Web supposedly the irs must examine your records before they issue a form 4549. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person.

Web Form 4549, Report Of Income Tax Examination Changes, A Report Showing The Proposed Adjustments To Your Tax Return, Will Be Enclosed With The Letter.

Web steps in response to form 4549. Include a statement explaining why you disagree with form 4549. You'll need to provide a copy of irs form 4549 with your request for reconsideration. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations.

Form 4549, Income Tax Examination Changes, Can Be A Refund Claim.

Web a regular agreed report (form 4549) may contain up to three tax years. You disagree with the tax the irs says you owe. Disagree with an internal revenue service (irs) audit and the additional tax the irs says you owe in taxes? The irs might also use form 5278.

You Have New Information To Show The Irs About The Audit Of Your Income Or Expenses.

You can file for an audit reconsideration under certain circumstances authorized. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. But, often times, it seems they ignore your evidence or reject it with little or no explanation at all. May 30, 2019 · 5 minute read.

Web Supposedly The Irs Must Examine Your Records Before They Issue A Form 4549.

The irs will then review your case and. Catalog number 23105a www.irs.gov form 4549 (rev. This is only a proposal & they may issue revisions if you present further evidence. The irs uses form 4549 for one of two reasons: