Ga Form 500 Nol

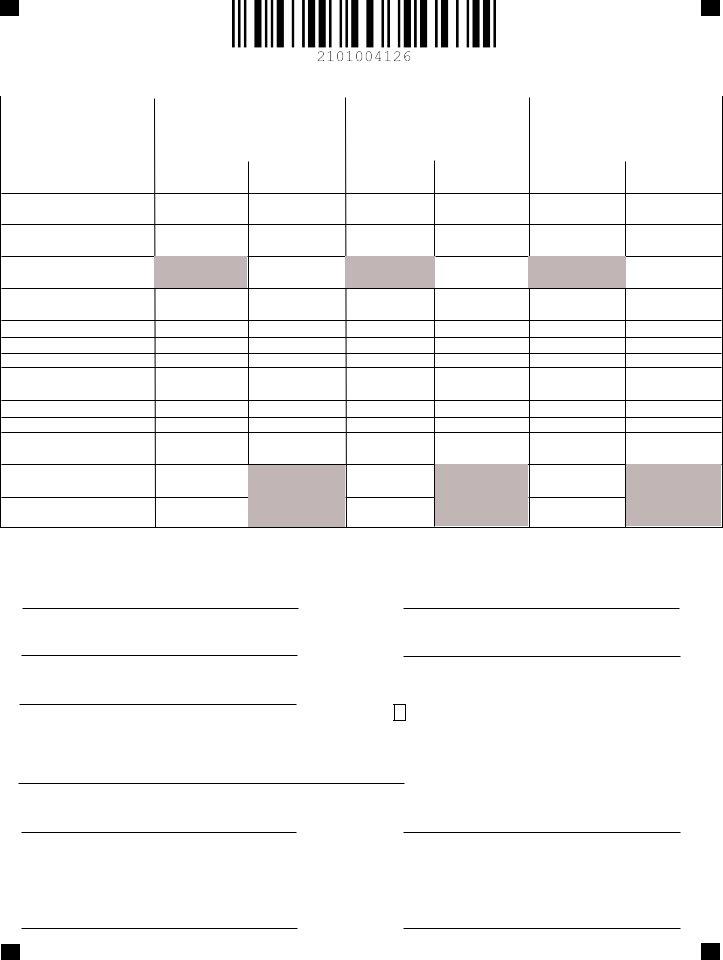

Ga Form 500 Nol - A taxpayer has a large net operating loss in 1998 (both federal and georgia). Complete, save and print the form online using your browser. For carryback purposes, the form must be filed no later than 3 years from. (approved web version) page 1. If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. Georgia department of revenue processing center po.

Georgia department of revenue processing center po box. We last updated the net operating loss. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed. Georgia department of revenue processing center po. It appears you don't have a pdf plugin for this browser.

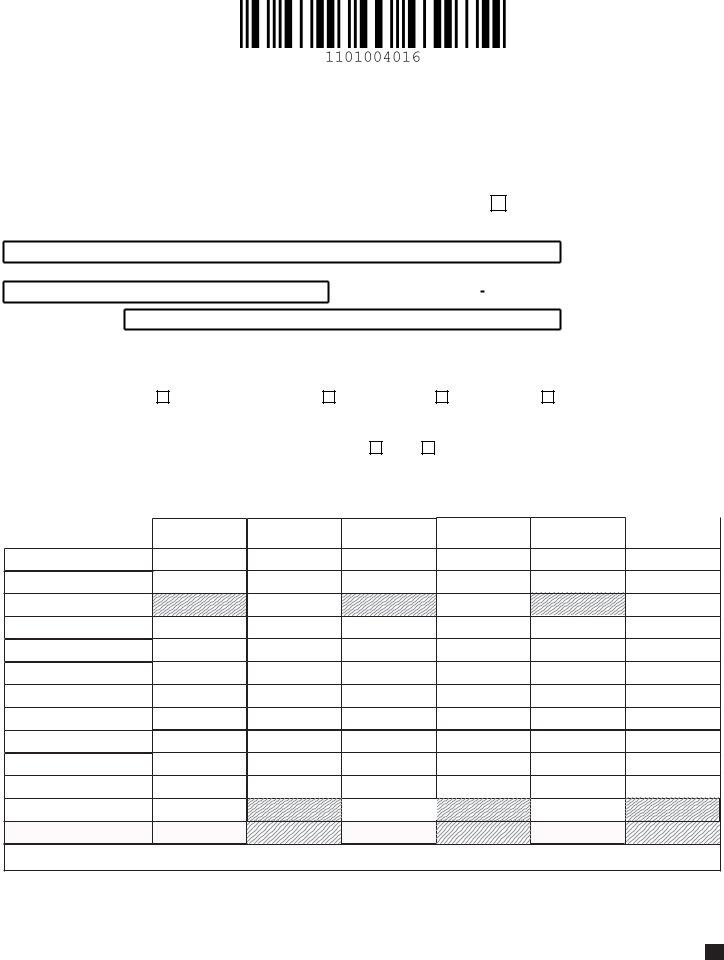

03/05/18) for individuals and fiduciaries. Net operating loss adjustment for individuals and fiduciaries(rev. Web claimed nol on georgia form 500 for tax year 2019. Nol was carried foward from irs form 1040. 08/30/23) individual income tax return.

Georgia — net operating loss adjustment. Net operating loss adjustment for individuals and fiduciaries (rev. Georgia department of revenue processing center po. Web georgia form 500 (rev. 08/30/23) individual income tax return.

Nol was carried foward from irs form 1040. How to generate the ga 500nol in a prior year in 1040 return. Georgia department of revenue processing center. Net operating loss adjustment for other than corporations (rev. 03/05/18) for individuals and fiduciaries.

09/12/19) your ssn or fein. Net operating loss adjustment for individuals and fiduciaries (rev. Net operating loss adjustment for other than corporations (rev. Web a net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating. Net operating loss adjustment for.

Please add this form to the. Web georgia form 500 (rev. If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. Web claimed nol on georgia form 500 for tax year 2019. Georgia department of revenue processing center po.

09/12/19) your ssn or fein. Georgia department of revenue processing center. Georgia department of revenue processing center po. Georgia department of revenue processing center po box. Web intuit accountants community.

Web instead the part year and nonresident schedule above should be completed. Georgia department of revenue processing center po box. Georgia — net operating loss adjustment. Net operating loss adjustment for individuals and fiduciaries. Complete, save and print the form online using your browser.

Georgia department of revenue processing center po box. There are no carrybacks in prior years on the federal tax. Complete, save and print the form online using your browser. Web claimed nol on georgia form 500 for tax year 2019. Net operating loss adjustment for other than corporations (rev.

Ga Form 500 Nol - If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. We last updated the net operating loss. Web intuit accountants community. (approved web version) page 1. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed. Georgia department of revenue processing center. 08/30/23) individual income tax return. Georgia department of revenue processing center po box. Georgia department of revenue processing center po box. For carryback purposes, the form must be filed no later than 3 years from.

Net operating loss adjustment for other than corporations (rev. Georgia — net operating loss adjustment. If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. There are no carrybacks in prior years on the federal tax. Georgia department of revenue processing center po box.

Web a net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating. For carryback purposes, the form must be filed no later than 3 years from. We last updated the net operating loss. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed.

We last updated the net operating loss. It appears you don't have a pdf plugin for this browser. Net operating loss adjustment for individuals and fiduciaries.

If the loss year is a part year or nonresident year for lines 3a, 3b, 6, and 11, compute. Nol was carried foward from irs form 1040. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed.

A Taxpayer Has A Large Net Operating Loss In 1998 (Both Federal And Georgia).

It appears you don't have a pdf plugin for this browser. Nol was carried foward from irs form 1040. Web georgia form 500 (rev. For carryback purposes, the form must be filed no later than 3 years from.

Georgia Department Of Revenue Processing Center Po Box.

Net operating loss adjustment for other than corporations (rev. Net operating loss adjustment for individuals and fiduciaries(rev. There are no carrybacks in prior years on the federal tax. The other state(s) tax credit and low income credit are claimed directly on form 500.

09/12/19) Your Ssn Or Fein.

Web instead the part year and nonresident schedule above should be completed. Complete, save and print the form online using your browser. Georgia department of revenue processing center po box. (approved web version) page 1.

If The Loss Year Is A Part Year Or Nonresident Year For Lines 3A, 3B, 6, And 11, Compute.

Net operating loss adjustment for individuals and fiduciaries (rev. Web a net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating. Web intuit accountants community. Web claimed nol on georgia form 500 for tax year 2019.