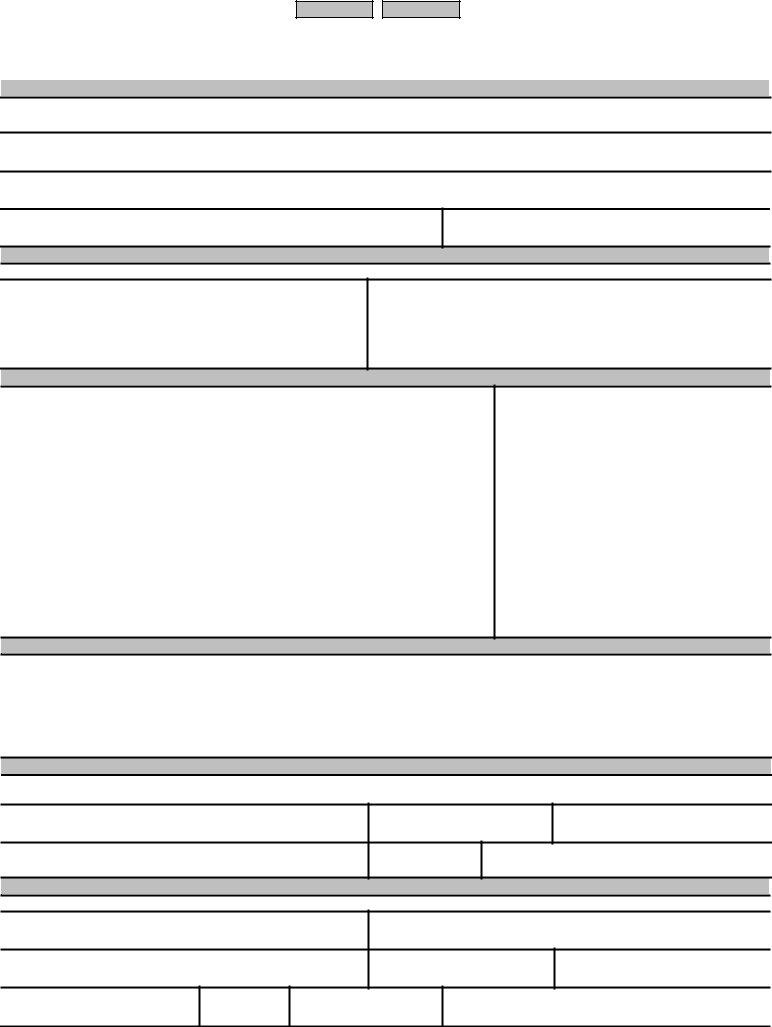

Form Std 204

Form Std 204 - 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. 10/2019) requirement to complete the payee. Web 1.1 about this guidance. California energy commission 715 p street sacramento, ca 95814. Use this form to provide additional remittance. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law.

Web payee data record (std 204) checklist/quick tips. Contact us | directions language services. Web the purpose of the std. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. Web 1.1 about this guidance.

204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. Web prepare an appeal bundle for the court of appeal (form 204) find out how to organise your documents (‘bundle’) in the standard way so that a judge can. Complete all information on this form. Sign, date, and return to the state agency (department/office).

Web obtaining payee information (std. Must match the payee’s federal tax return) business name, dba. Web what is a payee data record form, std 204 and why must the payee complete it before the state can make a disbursement? 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law..

(required when receiving payment from the state of california. Web the std 204 form is also a required form to correctly establish the eligible suppliers for 1099 reporting in fi$cal. Web the purpose of the std. To file annual information returns correctly, below are the requirements for identifying and classifying. The purpose of the payee data record form, std.

Web the purpose of the std. Web payee data record (std 204) checklist/quick tips. Sign, date, and return to the state agency (department/office). Web if a payee fails to complete or provides incorrect information on the payee data record form std. Std 204 is payee data record form submitted by a supplier.

Use this form to provide additional remittance. (required when receiving payment from the state of california. 204, the agency/department will reduce the payee’s payment by withholding. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. Do not leave this line blank.

Web 1.1 about this guidance. Web obtaining payee information (std. (required when receiving payment from the state of california. Web payee data record (std 204) checklist/quick tips. Type or print the information.

Sign, date, and return to the state agency (department/office). (required when receiving payment from the state of california. Web 1.1 about this guidance. To file annual information returns correctly, below are the requirements for identifying and classifying. The purpose of the payee data record form, std.

The form contains necessary information for payee to receive payment without issues and is required for. Contact us | directions language services. Web prepare an appeal bundle for the court of appeal (form 204) find out how to organise your documents (‘bundle’) in the standard way so that a judge can. 204, is required for payments to all non. 204,.

Form Std 204 - Web 1.1 about this guidance. (required when receiving payment from the state of california. Web obtaining payee information (std. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. California energy commission 715 p street sacramento, ca 95814. Web payee data record (std 204) checklist/quick tips. Sign, date, and return to the state agency (department/office). 10/2019) requirement to complete the payee. 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. (required when receiving payment from the state of california.

Web payee data record (std 204) checklist/quick tips. Web prepare an appeal bundle for the court of appeal (form 204) find out how to organise your documents (‘bundle’) in the standard way so that a judge can. Do not leave this line blank. Web the std 204 form is also a required form to correctly establish the eligible suppliers for 1099 reporting in fi$cal. To file annual information returns correctly, below are the requirements for identifying and classifying.

204, the agency/department will reduce the payee’s payment by withholding. Complete all information on this form. Web obtaining payee information (std. Web the purpose of the std.

Will i need to continue providing departments. Web the purpose of the std. A completed payee data record, std.

Web payee data record (std 204) checklist/quick tips. Std 204 is payee data record form submitted by a supplier. 10/2019) requirement to complete the payee.

To File Annual Information Returns Correctly, Below Are The Requirements For Identifying And Classifying.

California energy commission 715 p street sacramento, ca 95814. This guidance sets out the statutory requirements for key stage 2 (ks2) national curriculum assessment and reporting for the academic year 2023 to 2024. Contact us | directions language services. 204, the agency/department will reduce the payee’s payment by withholding.

The Purpose Of The Payee Data Record Form, Std.

10/2019) requirement to complete the payee. A completed payee data record, std. Web prepare an appeal bundle for the court of appeal (form 204) find out how to organise your documents (‘bundle’) in the standard way so that a judge can. Web the purpose of the std.

(Required When Receiving Payment From The State Of California.

Sign, date, and return to the state agency (department/office). Web if a payee fails to complete or provides incorrect information on the payee data record form std. Web obtaining payee information (std. The form contains necessary information for payee to receive payment without issues and is required for.

Web The Std 204 Form Is Also A Required Form To Correctly Establish The Eligible Suppliers For 1099 Reporting In Fi$Cal.

Will i need to continue providing departments. (required when receiving payment from the state of california. Must match the payee’s federal tax return) business name, dba. Use this form to provide additional remittance.