Form 3800 Turbota

Form 3800 Turbota - Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business credit, along with the irs forms for the individual credits. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to file. Part i reported current year credits that are not allowed against tentative. The 2022 version of form 3800 had just three parts. Web march 25, 2021 2:26 pm. It would have been far less aggravating had the intuit development department told the telephone reps.

Solved•by intuit•4•updated 4 days ago. Web new for form 3800 for tax year 2023: Solved•by intuit•30•updated 5 days ago. Tax information center filing credits. Complete a separate part iii of form 3800, notated as “ira22dpe,“ to elect to treat certain business credits reported and earned on.

Learn how to complete and file. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to file. Solved • by intuit • 3 • updated 4 days ago. Current year credit for credits not allowed against. Web new for form 3800 for tax year 2023:

Current year credit for credits not allowed against. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business credit, along with the irs forms for the individual credits. Web these supplemental instructions explain how to. Web draft form 3800 has three new parts. You will find the form 3800 by following.

The general business credit (form. Part i reported current year credits that are not allowed against tentative. Web if the sum of all credits is larger than a business' total tax liability, the business must use form 3800 to record the credits in a specific order. Web tax breaks and money. Fast, easy, reliabletax returns in 10 minuteslimited time offer

Web march 1, 20215:36 pm. Web form 3800 (2023) treasury/irs page 3 part iii current year general business credits (gbcs) (see instructions). How to enter information for form 3800 in proconnect tax. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business credit, along with the irs forms for the individual.

Web these supplemental instructions explain how to. Last updated march 01, 20215:36 pm. How to enter information for form 3800 in lacerte. Below are solutions to frequently asked. Complete a separate part iii of form 3800, notated as “ira22dpe,“ to elect to treat certain business credits reported and earned on.

March 25, 2021 2:37 pm. Web draft form 3800 has three new parts. The general business credit (form. Form 3800 is used by filers to claim any of the. Solved • by intuit • 3 • updated 4 days ago.

Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back or forward. Current year credit for credits not allowed against. Web let’s start by going irs form 3800, step by step. Learn how to complete and file. Part i reported current year credits that are not allowed against tentative.

Web although the forms availability table for turbotax business indicates that form 3800 is ready for filing, there have been recent developments that required. Select the links below to see. Web draft form 3800 has three new parts. How to enter information for form 3800 in proconnect tax. Web common questions about fiduciary general business credit (form 3800) in lacerte.

Form 3800 Turbota - The windows version of turbotax (for 2023 taxes to be filed march 15, 2024) says that the general business credit is not yet done (irs). Web is form 3800 ready? Solved•by intuit•4•updated 4 days ago. Web new for form 3800 for tax year 2023: March 25, 2021 2:37 pm. Select the links below to see. The general business credit (form. See this turbotax support faq for irs. Last updated march 01, 20215:36 pm. It would have been far less aggravating had the intuit development department told the telephone reps.

Fast, easy, reliabletax returns in 10 minuteslimited time offer Solved•by intuit•30•updated 5 days ago. Web these supplemental instructions explain how to. Web march 25, 2021 2:26 pm. March 25, 2021 2:37 pm.

Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business credit, along with the irs forms for the individual credits. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to file. How to enter information for form 3800 in proconnect tax. Web draft form 3800 has three new parts.

Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back or forward. How do i complete irs form 3800? Web these supplemental instructions explain how to.

Do you have an intuit account? How to enter information for form 3800 in lacerte. Web new for form 3800 for tax year 2023:

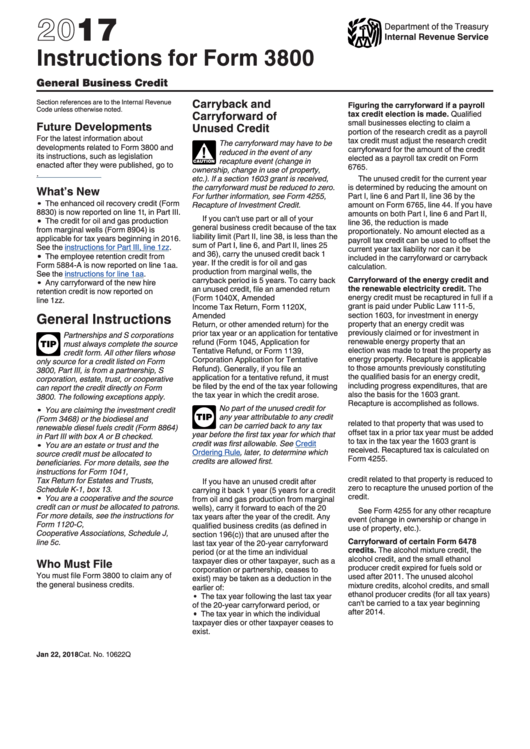

Carryback And Carryforward Of Unused Credit.

How do i complete irs form 3800? Web form 3800 (2023) treasury/irs page 3 part iii current year general business credits (gbcs) (see instructions). If there is more than one credit amount to. Do you have an intuit account?

The 2022 Version Of Form 3800 Had Just Three Parts.

Solved • by intuit • 3 • updated 4 days ago. Web march 1, 20215:36 pm. Web form 3800 is finally ready and included with the latest update of turbotax. Tax information center filing credits.

Web Let’s Start By Going Irs Form 3800, Step By Step.

Form 3800 is used by filers to claim any of the. Web march 25, 2021 2:26 pm. Fast, easy, reliabletax returns in 10 minuteslimited time offer Web common questions about fiduciary general business credit (form 3800) in lacerte.

March 25, 2021 2:37 Pm.

Web although the forms availability table for turbotax business indicates that form 3800 is ready for filing, there have been recent developments that required. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to file. Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back or forward. How to enter information for form 3800 in lacerte.