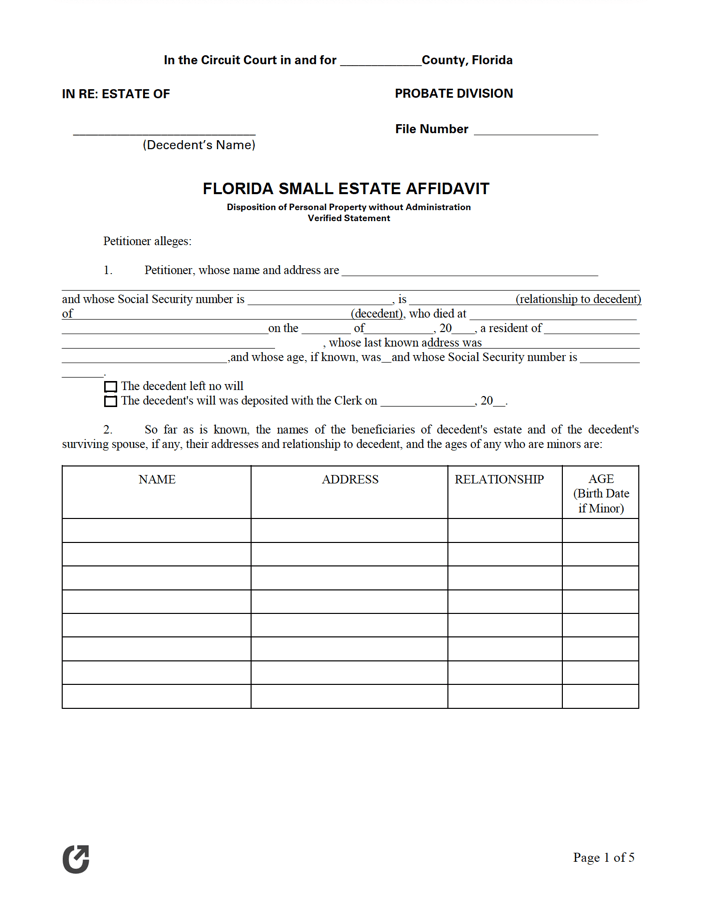

Florida Disposition Without Administration Form

Florida Disposition Without Administration Form - (2) the description and value of the other assets of the decedent; No administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. Complete the disposition of personal property without administration affidavit (required). 735.301 disposition without administration.— (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. Web to obtain a disposition of personal property without administration, any interested party must satisfy the requirements of section 735.301 of the florida statutes and file the completed forms and documents as follows: § 735.201) for disposition of personal property without administration, the process is only available to transfer assets up to the value of final expenses incurred, accounting for funeral expenses and reasonable and necessary medical and hospital expenses of the last 60 days of the last illness.

Web under section 735.301(1), florida statutes, disposition without administration, no administration shall be required, or formal proceedings instituted upon the estate of a decedent leaving only: Web the 2023 florida statutes (including special session c) 735.301 disposition without administration.—. Web no administration shall be required or formal proceedings instituted upon the estate of the decedent leaving only the personal property exempt under the provisions of s. (2) the description and value of the other assets of the decedent; Review and sign the p applicable certification clause at the end of the checklist prior to submitting it with your petition.

732.402, personal property exempt from the claims of creditors under the constitution of florida, and nonexempt personal property the value of which does not exceed Disposition of personal property without administration. Web no administration shall be required or formal proceedings instituted upon the estate of the decedent leaving only the personal property exempt under the provisions of s. 735.301 disposition without administration.— (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. There’s a small filing fee;

Web to apply for this process and request reimbursement, you file a form called “disposition of personal property without administration.” this form is available from the clerk of the court and on many florida circuit courts’ websites. 735.301 disposition without administration.— (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal.

735.301 disposition without administration.— (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. Petitioner requests that the court issue a letter or other writing under the seal of the court authorizing payment, transfer, or disposition of the property to: Web an interested person.

Web disposition of personal property without administration. 732.402, personal property exempt from the claims of creditors under the Web to obtain a disposition of personal property without administration, any heir must satisfy the requirements of f.s. (2) the description and value of the other assets of the decedent; Web in and for pasco county, florida probate division in re:

732.402, personal property exempt from the claims of creditors under the (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. Claims against small estates that fall within the following categories may be paid/satisfied simply by completing and then filing this verified statement with.

Web a disposition without administration is the probate process used to quickly transfer the ownership of the decedent’s small estate to an heir or beneficiary. ** must wait 30 days after date of death ** ***a filing fee of $101.00 is required at the time of filing (cash, local check, money order or credit card) *** Web disposition of personal.

735.304 and file the completed forms as follows: (1) the description and value of the exempt property; Petitioner requests that the court issue a letter or other writing under the seal of the court authorizing payment, transfer, or disposition of the property to: (2) the description and value of the other assets of the decedent; 732.402, personal property exempt from.

Claims against small estates that fall within the following categories may be paid/satisfied simply by completing and then filing this verified statement with the required documents and obtaining an order of the court. Web to obtain a disposition of personal property without administration, any interested party must satisfy the requirements of section 735.301 of the florida statutes and file the.

Florida Disposition Without Administration Form - The estate of decedent consists only of personal property exempt under the provisions of section 732.402 of the florida probate code, personal property exempt from the claims of creditors under the constitution of florida, and nonexempt personal property the value of which does not exceed the sum of the amount of preferred funeral expenses. Web to obtain a disposition of personal property without administration, you must file the completed forms as follows: Web no administration shall be required or formal proceedings instituted upon the estate of the decedent leaving only the personal property exempt under the provisions of s. 732.402, personal property exempt from the claims of creditors under the constitution of florida, and nonexempt personal property the value of which does not exceed Review and sign the p applicable certification clause at the end of the checklist prior to submitting it with your petition. There’s a small filing fee; Call ahead or check the court’s website to find out the exact cost. Web disposition of personal property without administration (fla. 732.402, personal property exempt from the claims of creditors under the § 735.201) for disposition of personal property without administration, the process is only available to transfer assets up to the value of final expenses incurred, accounting for funeral expenses and reasonable and necessary medical and hospital expenses of the last 60 days of the last illness.

732.402, personal property exempt from the claims of creditors under the 732.402, personal property exempt from the claims of creditors under the constitution of florida, and nonexempt personal property the value of which does not exceed Web in and for broward county, florida probate division. Web other debts of decedent: 735.304 and file the completed forms as follows:

Complete the disposition of personal property without administration affidavit (required). Web no administration shall be required or formal proceedings instituted upon the estate of the decedent leaving only the personal property exempt under the provisions of s. 732.402, personal property exempt from the claims of There’s a small filing fee;

Web instruction sheet for disposition of personal property without administration florida statute 732.402, 735.301 and florida probate rules 5.420 & 5.205(a)(4) probate is the legal process of the administration of a deceased person’s estate. Web to obtain a disposition of personal property without administration, any interested party must satisfy the requirements of section 735.301 of the florida statutes and file the completed forms and documents as follows: Web (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s.

732.402, personal property exempt from the claims of 735.301) this probate proceeding is used to request release of assets of a decedent leaving only personal property as described in fla. ** must wait 30 days after date of death ** ***a filing fee of $101.00 is required at the time of filing (cash, local check, money order or credit card) ***

Disposition Of Personal Property Without Administration.

Web no administration shall be required or formal proceedings instituted upon the estate of the decedent leaving only the personal property exempt under the provisions of s. Web (1) no administration shall be required or formal proceedings instituted upon the estate of a decedent leaving only personal property exempt under the provisions of s. Web the 2023 florida statutes (including special session c) 735.301 disposition without administration.—. Web to obtain a disposition of personal property without administration, any interested party must satisfy the requirements of section 735.301 of the florida statutes and file the completed forms and documents as follows:

The Estate Of Decedent Consists Only Of Personal Property Exempt Under The Provisions Of Section 732.402 Of The Florida Probate Code, Personal Property Exempt From The Claims Of Creditors Under The Constitution Of Florida, And Nonexempt Personal Property The Value Of Which Does Not Exceed The Sum Of The Amount Of Preferred Funeral Expenses.

732.402, personal property exempt from the claims of creditors under the constitution of florida, and nonexempt personal property the value of which does not exceed Web a disposition without administration is the probate process used to quickly transfer the ownership of the decedent’s small estate to an heir or beneficiary. § 735.201) for disposition of personal property without administration, the process is only available to transfer assets up to the value of final expenses incurred, accounting for funeral expenses and reasonable and necessary medical and hospital expenses of the last 60 days of the last illness. An application signed by the applicant shall set forth:

732.402, Personal Property Exempt From The Claims Of Creditors Under The Constitution Of Florida, And Nonexempt Personal Property The Value Of Which Does Not Exceed The Sum Of The.

(1) the description and value of the exempt property; Personal property exempt from the claims of creditors under the constitution of florida; Web under section 735.301(1), florida statutes, disposition without administration, no administration shall be required, or formal proceedings instituted upon the estate of a decedent leaving only: This type of proceeding allows reimbursement to a person who paid for final expenses, which are funeral costs or medical bills that accrued in the last 60 days.

Web To Obtain A Disposition Of Personal Property Without Administration, Any Heir Must Satisfy The Requirements Of F.s.

Web an interested person may request a disposition of the decedent's personal property without administration. 732.402, personal property exempt from the claims of creditors under the. Web to obtain a disposition of personal property without administration, you must file the completed forms as follows: Web disposition of personal property without administration.