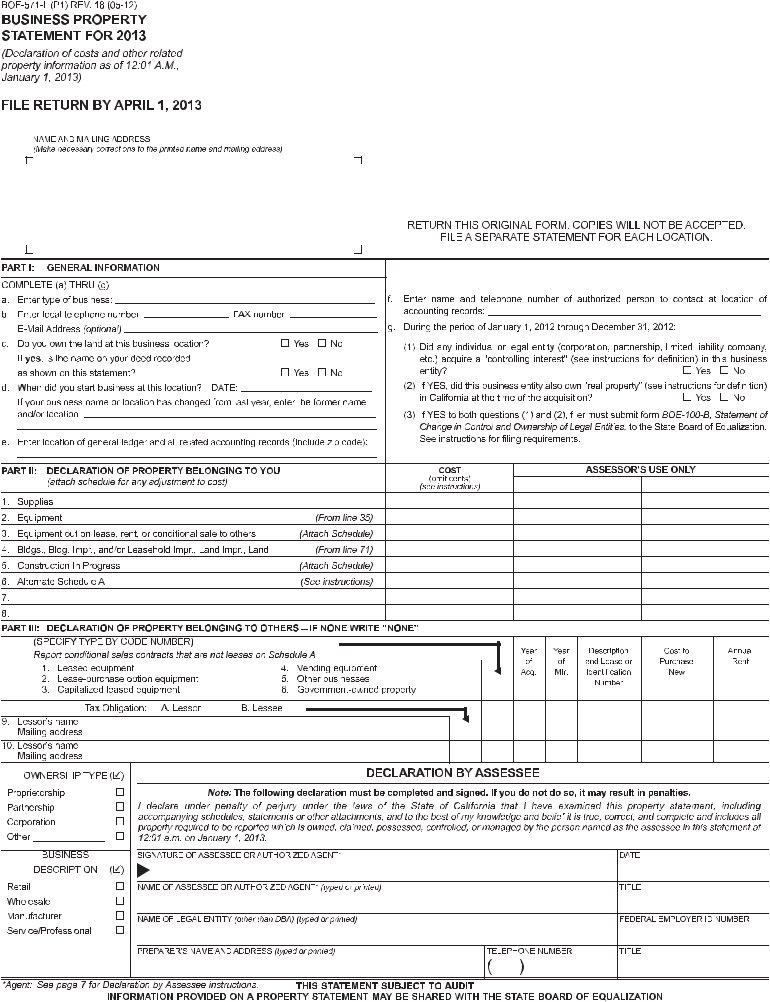

Ca Form 571 L

Ca Form 571 L - For a list of important deadlines go to related links below. Web a business property statement is a form, or a series of reporting forms upon which both real and personal property must be declared as such assets exist on the lien date. 2024 busi ness proper ty statement. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Accounts that have filed for an. County of los angeles office of the assessor business property statement california law prescribes a yearly ad valorem tax.

County of los angeles office of the assessor business property statement california law prescribes a yearly ad valorem tax. Per revenue and taxation code, section 441, you must file a statement if: Per revenue and taxation code, section 441, you must file a statement if: Have your account number and business. 2024 busi ness proper ty statement.

Pursuant to california revenue and taxation code sections 441 (b). Have your account number and business. This link takes you to the centralized. Name and mailing address (make necessary corrections to the printed name and mailing address) this page watermarked sample only contact assessor for actual form. The 571l (bps) form is used to declare cost information.

A) the assessor’s office has sent you a notice of requirement. For a list of important deadlines go to related links below. Accounts that have filed for an. A) the assessor’s office has sent you a notice of requirement. Web a business property statement is a form, or a series of reporting forms upon which both real and personal property.

Per revenue and taxation code, section 441, you must file a statement if: Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. For a list of important deadlines go to related links below. Businesses are required by law to file a business property statement if the aggregate cost of.

The 571l (bps) form is used to declare cost information. Per revenue and taxation code, section 441, you must file a statement if: Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Pursuant to california revenue and taxation code sections 441 (b). Web a business property statement is a.

Per revenue and taxation code, section 441, you must file a statement if: Per revenue and taxation code, section 441, you must file a statement if: County of los angeles office of the assessor business property statement california law prescribes a yearly ad valorem tax. Accounts that have filed for an. A) the assessor’s office has sent you a notice.

Web filing form 571l business property statement. The 571l (bps) form is used to declare cost information. Per revenue and taxation code, section 441, you must file a statement if: Per revenue and taxation code, section 441, you must file a statement if: A) the assessor’s office has sent you a notice of requirement.

Per revenue and taxation code, section 441, you must file a statement if: Pursuant to california revenue and taxation code sections 441 (b). The 571l (bps) form is used to declare cost information. Web filing form 571l business property statement. County of los angeles office of the assessor business property statement california law prescribes a yearly ad valorem tax.

Per revenue and taxation code, section 441, you must file a statement if: Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Name and mailing address (make necessary corrections to the printed name and mailing address) this page watermarked sample only contact assessor for actual form. A) the assessor’s.

Ca Form 571 L - This link takes you to the centralized. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. Web a business property statement is a form, or a series of reporting forms upon which both real and personal property must be declared as such assets exist on the lien date. Per revenue and taxation code, section 441, you must file a statement if: Web filing form 571l business property statement. Have your account number and business. A) the assessor’s office has sent you a notice of requirement. For a list of important deadlines go to related links below. A) the assessor’s office has sent you a notice of requirement. Per revenue and taxation code, section 441, you must file a statement if:

Have your account number and business. Per revenue and taxation code, section 441, you must file a statement if: 2024 busi ness proper ty statement. Name and mailing address (make necessary corrections to the printed name and mailing address) this page watermarked sample only contact assessor for actual form. For a list of important deadlines go to related links below.

Web filing form 571l business property statement. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. A) the assessor’s office has sent you a notice of requirement. Have your account number and business.

Per revenue and taxation code, section 441, you must file a statement if: A) the assessor’s office has sent you a notice of requirement. Web this is an annual filing that is required in each of the california counties where your business(es) is located.

A) the assessor’s office has sent you a notice of requirement. Per revenue and taxation code, section 441, you must file a statement if: A) the assessor’s office has sent you a notice of requirement.

Pursuant To California Revenue And Taxation Code Sections 441 (B).

For a list of important deadlines go to related links below. County of los angeles office of the assessor business property statement california law prescribes a yearly ad valorem tax. 2024 busi ness proper ty statement. Accounts that have filed for an.

A) The Assessor’s Office Has Sent You A Notice Of Requirement.

Web this is an annual filing that is required in each of the california counties where your business(es) is located. Web filing form 571l business property statement. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Per revenue and taxation code, section 441, you must file a statement if:

The 571L (Bps) Form Is Used To Declare Cost Information.

Web a business property statement is a form, or a series of reporting forms upon which both real and personal property must be declared as such assets exist on the lien date. Have your account number and business. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. Per revenue and taxation code, section 441, you must file a statement if:

This Link Takes You To The Centralized.

Per revenue and taxation code, section 441, you must file a statement if: A) the assessor’s office has sent you a notice of requirement. A) the assessor’s office has sent you a notice of requirement. Name and mailing address (make necessary corrections to the printed name and mailing address) this page watermarked sample only contact assessor for actual form.