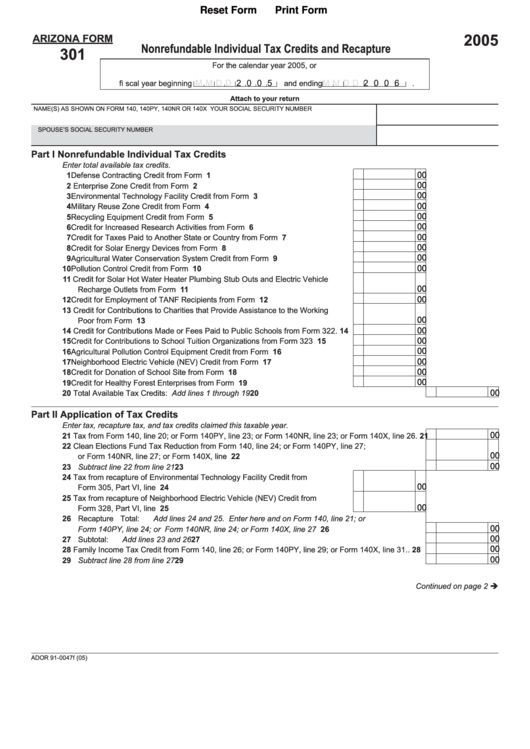

Arizona Ta Form 301

Arizona Ta Form 301 - When form 301 is not required. Web file now with turbotax. X summarize your total available nonrefundable tax credits. If you're claiming a tax credit, you cannot use the short forms 140a or 140ez, as these forms do not have fields for the tax credits. Enter tax, recapture tax, and tax credits used this taxable year. You will find the credits in the final part of the arizona interview.

Summarization of taxpayer's application of nonrefundable tax credits and credit recapture amounts for the taxable year. If you're claiming a tax credit, you cannot use the short forms 140a or 140ez, as these forms do not have fields for the tax credits. Web you can claim tax credits by completing form 321 and form 301 and attaching them to your arizona tax return. Ador 10127 (15) a orm 301 2015 page 2 of 2. Web you must complete and arizona include form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Enter tax, recapture tax, and tax credits used this taxable year. Enter total available tax credits. Part 1 nonrefundable individual tax credits available: You must complete and include arizona form 301 with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required.

Part 2 application of tax credits and recapture: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Web file now with turbotax. Enter total available tax credits. When form 301.

Ador 10127 (19) a orm 301 2019 page 2 of 2. Enter total available tax credits. 32 tax from form 140, line 46; Or form 140py, line 56; It appears you don't have a pdf plugin for this browser.

Form 335 is used in claiming the corporate tax credit. You must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax.

Enter total available tax credits. Ador 10127 (19) a orm 301 2019 page 2 of 2. This form is for income earned in tax year 2023, with tax returns due in april 2024. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet.

Number part 2 application of tax credits and recapture enter tax, recapture tax, and tax credits used this taxable year. 2022 nonrefundable individual tax credits and recapture arizona form 301. Enter total available tax credits. Summarize your total available nonrefundable tax credits. Web arizona form 301 nonrefundable individual tax credits and recapture 2018.

Or form 140py, line 56; You must complete and include arizona form 301 with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Enter tax, recapture tax, and tax credits used this taxable year. X summarize your total available nonrefundable tax credits. Tax year.

For information or help, call one of the numbers listed: Tax forms, instructions, and other tax information. 2022 nonrefundable individual tax credits and recapture arizona form 301. Number part 2 application of tax credits and recapture enter tax, recapture tax, and tax credits used this taxable year. Web arizona form 301 nonrefundable individual tax credits and recapture 2018.

Arizona Ta Form 301 - Part 2 application of tax credits and recapture: For information or help, call one of the numbers listed: Enter total available tax credits. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. This form is for income earned in tax year 2023, with tax returns due in april 2024. Web arizona form 301 nonrefundable individual tax credits and recapture 2019. You will find the credits in the final part of the arizona interview. • summarize your total available nonrefundable tax credits. Web arizona form nonrefundable individual tax credits and recapture for. Web arizona form 301 nonrefundable individual tax credits and recapture 2018.

We last updated arizona form 301 in january 2024 from the arizona department of revenue. It appears you don't have a pdf plugin for this browser. Enter tax, recapture tax, and tax credits used this taxable year. (a) current year credit (b). Ador 10127 (19) a orm 301 2019 page 2 of 2.

It appears you don't have a pdf plugin for this browser. Web you can claim tax credits by completing form 321 and form 301 and attaching them to your arizona tax return. Or form 140py, line 58; Ador 10127 (19) a orm 301 2019 page 2 of 2.

Enter tax, recapture tax, and tax credits used this taxable year. Web arizona form nonrefundable individual tax credits and recapture for. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required.

Ador 10127 (19) a orm 301 2019 page 2 of 2. Form 335 is used in claiming the corporate tax credit. Ador 10127 (14) a orm 301 2014 page 2 of 2 your name (as shown on page 1) your social security number.

42 00 43 Subtract Line 42 From Line 41.

Summarize your total available nonrefundable tax credits. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under when form 301 is not required. Or form 140py, line 61; 38 00 39 subtract line 38 from line 37.

Web Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture 2019.

• summarize your total available nonrefundable tax credits. Tax forms, instructions, and other tax information. 301 forms 140, 140py, 140nr and 140x 2022. If you're claiming a tax credit, you cannot use the short forms 140a or 140ez, as these forms do not have fields for the tax credits.

Ador 10127 (14) A Orm 301 2014 Page 2 Of 2 Your Name (As Shown On Page 1) Your Social Security Number.

Enter tax, recapture tax, and tax credits used this taxable year. You must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the exceptions listed under. You will find the credits in the final part of the arizona interview. Ador 10127 (19) a orm 301 2019 page 2 of 2.

Web We Last Updated The Nonrefundable Individual Tax Credits And Recapture In January 2024, So This Is The Latest Version Of Form 301, Fully Updated For Tax Year 2023.

• summarize your total available nonrefundable tax credits. Web file now with turbotax. This form requires two essential elements: Web arizona form nonrefundable individual tax credits and recapture for.