An Advantage Of The Partnership Form Of Business Organization Is

An Advantage Of The Partnership Form Of Business Organization Is - Web being a partnership, the business owners necessarily share the profits, the liabilities and the decision making. A successful partnership can help a business thrive by allowing partners to pool their resources and labor. An advantage of the partnership form of business organization is. The risk of a lawsuit being filed against the. This is a business structure that allows you and at least one other person to both have ownership of the business. The partnership business does not need to complete a corporation tax return, but you’ll still need to keep records of.

In other words, although the individual partners are taxed at the individual level, the partnership itself (as a business unit) is not subject to income tax. A successful partnership can help a business thrive by allowing partners to pool their resources and labor. Web included in the advantages of the partnership form of business organization are. The degree to which you are willing to deal with “ structure.” d. This is one of the advantages of partnership, especially where the partners have different skills and can work well together.

Can give you access to a broader range of expertise for different parts of your business. The owners of a partnership have invested their own funds and time in the business, and share proportionally in any profits earned by it. Multiple types of partnerships exist. More possibility of growth and expansion 13. Take the following factors into consideration before making your decision:

The partnership business does not need to complete a corporation tax return, but you’ll still need to keep records of. An advantage of the partnership form of business organization is. Web advantages and disadvantages of partnerships. Web kaylee dewitt | oct 26, 2022. Multiple types of partnerships exist.

Web list of the advantages of a partnership. Web included in the advantages of the partnership form of business organization are. Web 10 advantages of a partnership. A successful partnership can help a business thrive by allowing partners to pool their resources and labor. You may feel that a partnership is the right direction for your.

The owners of a partnership have invested their own funds and time in the business, and share proportionally in any profits earned by it. Web the advantages of the partnership form of business organization, compared to corporations, include a. Web kaylee dewitt | oct 26, 2022. Over the years, many partnerships have turned sour. Web advantages of a partnership.

Web the advantages of business partnerships may help your business better reach its goals, such as improving performance or increasing market share. An advantage of the partnership form of business organization is. Web being a partnership, the business owners necessarily share the profits, the liabilities and the decision making. Here’s the best way to solve it. This is a business.

It is easier to attract investors as a result of the limited liability. If you’re starting a business and have one or more partners, it might seem obvious to form a business partnership. Banks are more likely to lend money to an organisation that has many partners than to a sole trader. Web some advantages of partnerships include: Here’s the.

Web the advantages of the partnership form of business organization, compared to corporations, include a. This is a business structure that allows you and at least one other person to both have ownership of the business. This is one of the advantages of partnership, especially where the partners have different skills and can work well together. Compared to other business.

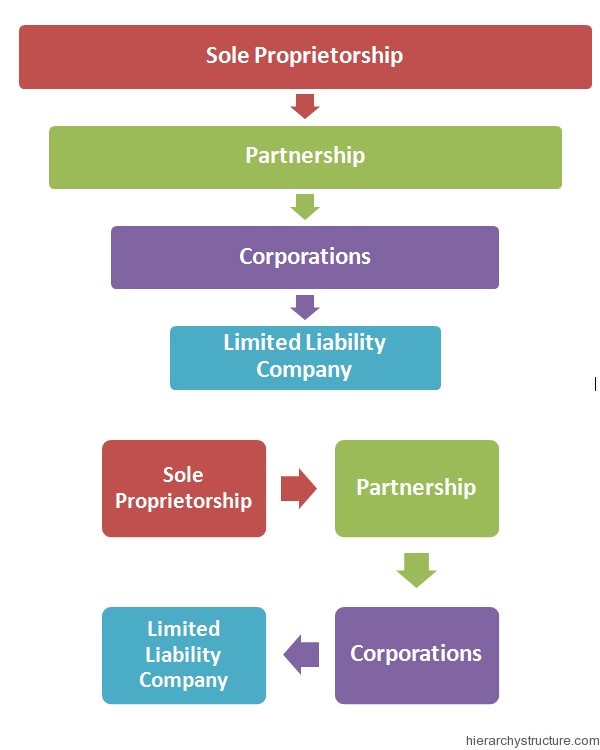

Each form has distinct advantages and disadvantages for the life of the business, the ability of. Web a partnership is a business entity in which two or more people or businesses work together as one company or business. An advantage of the partnership form of business organization is. Web list of the advantages of a partnership. A partnership is a.

An Advantage Of The Partnership Form Of Business Organization Is - Disadvantages of this can be: Partners have limited liability when it comes to problems and lawsuits. The advantages of the partnership form of business organization, compared to corporations, include _______. A partnership is a relation between two or more persons who join hands to form a business organization to earn a profit. An advantage of the partnership form of business organization is. Web being a partnership, the business owners necessarily share the profits, the liabilities and the decision making. The persons who join hands are individually known as ‘partner’ and collectively a. State fees must be paid and a certificate of limited partnership filed before the business can operate. Take a look at some of the benefits of a business partnership below. Even though forming a partnership might make sense, it’s not your only option.

The first choice is composed of partners who participate in the daily operations of the new company. Most sole proprietors do not. Web 10 advantages of a partnership. Web list of the advantages of a partnership. An advantage of the partnership form of business organization is.

If you’re starting a business and have one or more partners, it might seem obvious to form a business partnership. Your perspective on the size and character of your company. You may feel that a partnership is the right direction for your. Can give you access to a broader range of expertise for different parts of your business.

The owners of a partnership have invested their own funds and time in the business, and share proportionally in any profits earned by it. A partnership is a form of business organization in which owners have unlimited personal liability for the actions of the business. Web a partnership is a business entity in which two or more people or businesses work together as one company or business.

The first choice is composed of partners who participate in the daily operations of the new company. An advantage of the partnership form of business organization is. A successful partnership can help a business thrive by allowing partners to pool their resources and labor.

Take A Look At Some Of The Benefits Of A Business Partnership Below.

Web list of the advantages of a partnership. Here’s the best way to solve it. Web some advantages of partnerships include: Most states recognize three different partnership options:

Even Though Forming A Partnership Might Make Sense, It’s Not Your Only Option.

A partnership is a form of business organization in which owners have unlimited personal liability for the actions of the business. The degree to which you are willing to deal with “ structure.” d. This is one of the advantages of partnership, especially where the partners have different skills and can work well together. Web partnership form of business organization.

This Is A Business Structure That Allows You And At Least One Other Person To Both Have Ownership Of The Business.

The partnership business does not need to complete a corporation tax return, but you’ll still need to keep records of. The risk of a lawsuit being filed against the. Most sole proprietors do not. Partnerships can raise more finance than sole traders.

A Partnership Is A Business Organization In Which Two Or More People Agree To Share All The Profits.

Compared to other business structures, partnerships require minimal paperwork and legal documents to establish. More possibility of growth and expansion 13. Banks are more likely to lend money to an organisation that has many partners than to a sole trader. Partners have limited liability when it comes to problems and lawsuits.